Seven out of ten of the Bay Area counties have surpassed 2007 prices. I am so surprised. Surprised, I tell ya! And here I thought that all counties had surpassed 2007 prices. But I was wrong.

Why do we compare today to 2007? 2007 was the height of the real estate cycle (Note: real estate cycles typically last 7-10 years). It was a time when we had a lot of inventory and houses were flying off the shelf. If you could fill out a loan application then you could get a house- didn’t matter what you put on it. I had been in the business for a few years and remember thinking that it was crazy that this is how real estate was.

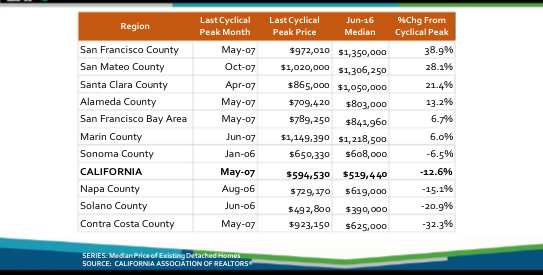

Fast forward to 2016, the next, and current, peak cycle. The sign of a recovering market is to compare prices from peak to peak, valley to valley. The California Association of Realtors just released their 2017 Housing Forecast and in it was this chart, which shocked me:

California as a whole has not recovered.

Contra Costa County, an area that we service, has also not recovered. Yes, the individual cities we service (El Cerrito, Kensington, and Richmond) have recovered, but the county as a whole has not. Why? The outlying areas near Antioch and Pittsburg had so much development, was hit really bad in 2011-2012, and is still recovering. In 2007 the median price in Antioch was $514,900; 2016 is $357,300. The good news is that only 11.5% of homes are underwater.

Check out San Francisco County: they surpassed the prior peak a long time ago with prices at 38.9% above 2007 prices.

Curious to know more about what your home is expected to do in 2017? Ping us – happy to share the scoop.