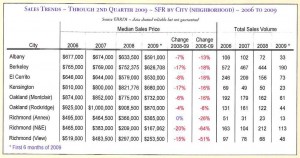

One of the biggest questions I get lately is “how much have prices goine down?” This is pretty easy to answer. If you look at the statistical date from the height of the market (2006 – 2007) and compare it to today’s numbers you will see that Richmond has taken the biggest hit, primarily because of foreclosures. Because of the decline in luxury sales (houses over $1 million) even cities like Rockridge, which historically holds stable, has seen a decline.

Cities like Berkeley are starting to see more and more foreclosures and short sales, but less and less inventory. In fact, most areas are seeing the same. One reason for lower inventory is that sellers who are able are holding onto their property and trying to wait out the storm. The downside in this is that buyers have less inventory to choose from so it is creating a multiple offer frenzy in many areas, which is ultimately increasing prices. But this is exactly what sellers are hoping for, prices to go up.

Buyers are trying to take advantage of this wave before rates creep up and the tax credit expires. Speaking from the buyers perspective, “Sellers, bring on your house!”